Two exchanges with different dynamics

In the global copper market, trading is concentrated on two main exchanges: the London Metal Exchange and the New York Commodity Exchange known as COMEX which is part of the CME Group. The LME is widely used as a benchmark for physical pricing around the world while COMEX reflects domestic conditions in the United States. Local factors such as logistics taxes and regulations can cause temporary differences between the two markets.

Arbitrage and spread movements

These differences create arbitrage opportunities. When prices on COMEX and LME diverge traders can buy copper on one exchange and sell it on the other to take advantage of the price gap.

For example if copper is trading higher on COMEX it may be profitable to buy it on the LME and sell it in the US market. This type of strategy is common in liquid markets and helps balance prices and redistribute physical inventories across regions.

Trade policy drives volatility in 2025

During 2025 the copper arbitrage became more relevant. In March rumors began to circulate about a potential US tariff on imports. Anticipating this measure US buyers increased purchases to avoid the possible extra cost. This led to a steady build up of inventories on COMEX.

At the same time copper supply outside the US became tighter which widened the price gap between both exchanges. The spread peaked at 18 percent showing a clear distortion in pricing.

In May and June uncertainty about the timing of the tariff caused the spread to ease slightly falling to levels between 10 and 11 percent. But on July 8 President Donald Trump officially announced a 50 percent tariff on copper imports.

The market reacted immediately. The arbitrage spread between COMEX and LME exceeded 2500 dollars per metric ton. This movement was driven by a surge in COMEX futures and weaker prices on the LME.

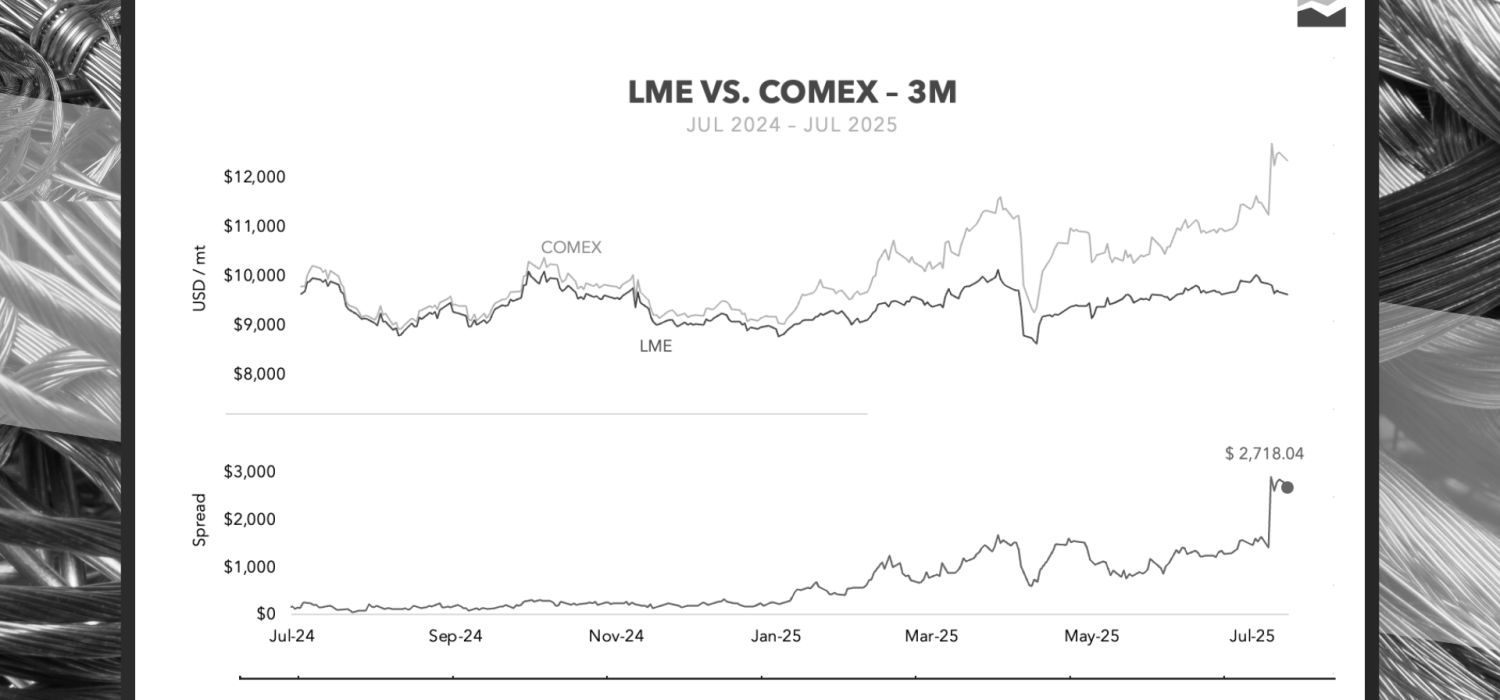

Chart showing the copper arbitrage between COMEX and LME

The chart below shows three month copper prices on COMEX and LME and the spread between them. In July 2025 the price gap jumped above 2700 dollars per ton reaching a new record. This was triggered by the announcement of a 50 percent tariff on copper from China. The situation revealed a strong disruption in regional price formation and showed how political measures can lead to lasting breaks in global pricing relationships.

What this means for international companies

This situation showed how trade and political decisions can temporarily distort the relationship between financial markets trading the same Commodity. Arbitrage served as a response mechanism helping to move inventories and reset market expectations. For companies with international exposure to copper monitoring these spreads can be important when making purchasing decisions or managing financial risk.

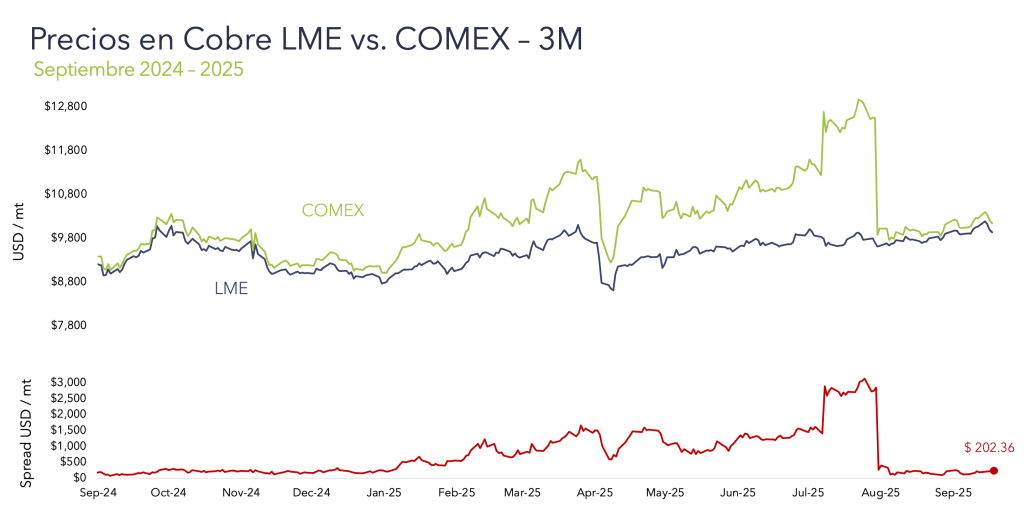

Updated copper prices LME vs. COMEX (September 2025)

As of September 19, 2025, the spread between COMEX and LME copper prices has returned to lower levels after the sharp distortions observed earlier this year. The difference, which peaked above USD 2,500/mt in July, now stands at only USD 202.36/mt.

COMEX prices are trading above LME, but the gap has narrowed considerably, showing a realignment with physical market fundamentals. This adjustment highlights how the exceptional volatility triggered by tariff announcements in the United States has eased, bringing back more balanced conditions between both exchanges.