The Houston Ship Channel index, known as HSC, is a crucial benchmark for natural gas trade in the Gulf of Mexico region. This indicator is used to establish the price of gas delivered in the Houston Ship Channel area, a strategic hub for U.S. logistics and energy consumption.

The region surrounding the Houston Ship Channel hosts one of the largest industrial concentrations in the country, including petrochemical plants, refineries, and power generators that rely on natural gas. This high local demand, combined with its connection to an extensive pipeline network and export terminals, underscores the relevance of this index in the market.

What defines the Houston Ship Channel Index

The Houston Ship Channel is a delivery point for multiple pipelines transporting natural gas from production areas such as South Texas and the Permian Basin. Its location enables efficient distribution to industrial consumers and liquefied natural gas (LNG) export terminals.

The index captures supply and demand conditions in this region, reflecting fluctuations in availability and consumption. This makes it a benchmark for natural gas transactions and contracts across the United States.

Factors influencing HSC prices

- High industrial demand

The region is home to numerous petrochemical plants and refineries that use natural gas as both an energy source and a raw material. These industries generate consistent demand, directly impacting prices. - Liquefied natural gas exports

The channel’s proximity to export terminals like Freeport and Sabine Pass, key for LNG trade to Europe and Asia, plays a role in price formation. Higher exports reduce domestic supply, raising HSC index prices. - Regional production and transportation

The proximity to major production areas like the Permian Basin ensures a steady supply, although pipeline disruptions or logistical bottlenecks can cause price fluctuations. - Seasonal consumption

In winter, heating needs increase demand, while summer sees a rise in electricity usage for air conditioning. These seasonal variations impact price dynamics throughout the year. - Storage capacity

Storage facilities in the region help balance supply during demand peaks, but low inventory levels can put upward pressure on prices.

Use of the Houston Ship Channel Index in natural gas trade

The Houston Ship Channel index is widely used by power generators, petrochemical industries, and natural gas exporters as a basis for calculating costs and negotiating contracts. It also serves as a reference for hedging strategies aimed at minimizing the impact of price fluctuations.

Moreover, the index acts as a key indicator for the Gulf region, linking local activity to broader trends in international markets. This is particularly evident in the LNG trade, where exports have grown rapidly in recent years.

International relevance of the HSC Index

The growing demand for LNG in markets such as Asia and Europe has increased the influence of the Houston Ship Channel index in global natural gas trade. As exports rise, the index reflects this dynamic, affecting decisions by producers and consumers in the region. This connection between local and international markets reinforces its role as a tool for understanding the energy market’s evolution.

The Houston Ship Channel remains a strategic hub for natural gas trade, not only for its ability to connect production and consumption but also for its impact on the commercial and operational decisions of companies that depend on this resource.

2025 update – Recent performance of the Houston Ship Channel index

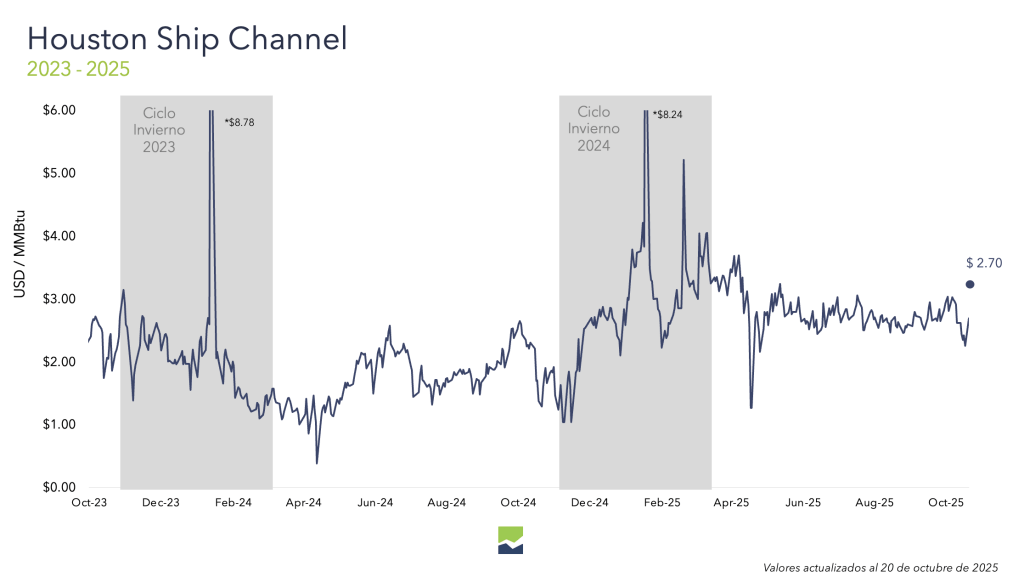

During the 2023 and 2024 winter cycles, the Houston Ship Channel (HSC) index experienced strong volatility.

- Winter 2023: Prices surged to $8.78/MMBtu, driven by intense cold conditions and temporary supply constraints.

- Winter 2024: A similar pattern emerged, with a peak of $8.24/MMBtu, influenced by high LNG export levels and robust regional demand.

By October 2025, the index stabilized around $2.70/MMBtu, reflecting a normalization of supply dynamics and improved balance between domestic consumption and exports.

This behavior underlines the importance of tracking weather patterns, infrastructure reliability, and export activity, as these elements continue to define price movements in the Gulf of Mexico’s natural gas market.