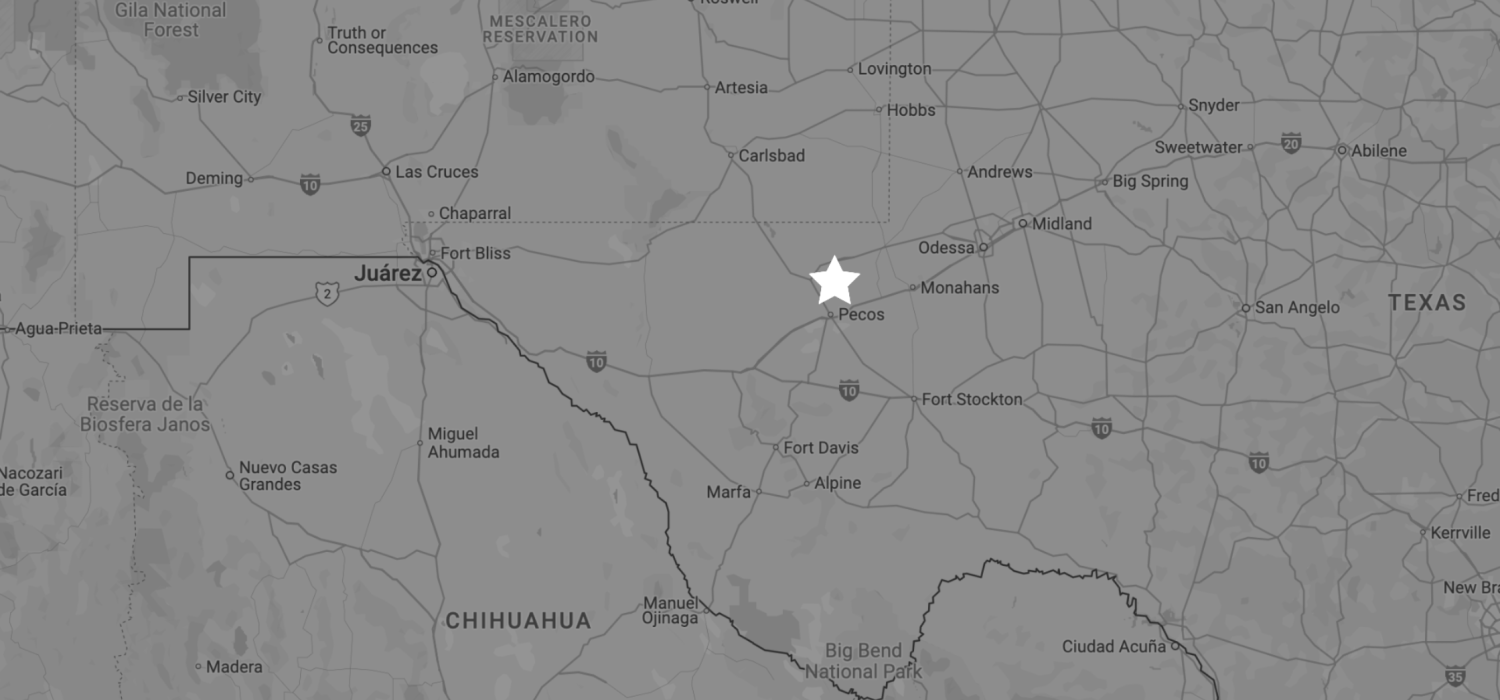

The Waha index is a significant benchmark for natural gas trading in the United States, particularly in West Texas. It is named after the Waha Hub, a key pipeline intersection located in Pecos County. The region is renowned for its intense hydrocarbon extraction activity, thanks to the Permian Basin, one of the world’s most important production areas.

Waha serves as a strategic point for connecting the region’s natural gas production to domestic and international markets. However, this index not only reflects local dynamics but also illustrates the logistical challenges and market opportunities arising in high-production areas with limited transport capacity.

Rapid growth in Natural Gas production

Natural gas production in West Texas has grown exponentially due to unconventional oil and gas development, known as fracking. This growth has made the Waha Hub a critical point for channeling large gas volumes into broader distribution networks. However, the rapid production increase has not always been matched by equivalent transport infrastructure expansion. This has led to oversupply situations, where excess gas in the region has pushed prices to historically low levels, and at times, even negative prices.

The impact of logistical constraints

The Waha index is particularly sensitive to logistical limitations. Insufficient pipeline capacity to transport gas to other regions has created bottlenecks that significantly impact prices. In such cases, producers are forced to lower prices to attract local buyers or, in extreme situations, resort to flaring or venting excess gas. These dynamics make Waha prices highly volatile, driven not only by supply and demand but also by the system’s capacity to handle large volumes.

Demand as a price driver in the region

Natural gas demand in the Waha index’s area of influence is primarily driven by the power generation and industrial sectors. However, the growth of exports to Mexico and the expansion of liquefied natural gas (LNG) export terminals have started to play a more significant role. Mexico, in particular, has become a key destination for gas produced in West Texas, with cross-border pipelines directly connecting the Waha Hub to markets in northern and central Mexico.

Seasonal price variations in the Waha Index

The Waha index also reflects seasonal market conditions for natural gas. In summer, increased electricity demand for air conditioning can drive higher gas consumption at power plants. In winter, while heating use in Texas is not as significant as in other regions, Waha’s connection to northern markets means its price is influenced by colder temperatures and increased demand in those areas.

Infrastructure development and Index stabilization

With the development of new infrastructure projects, the Waha index has started to stabilize. The construction of additional pipelines and the growth of export terminals have helped reduce the bottlenecks that historically affected prices. This not only benefits regional producers but also strengthens Waha’s position as a reliable benchmark in the natural gas market.

The evolution of the Waha Index in the U.S. Market

The Waha index continues to evolve alongside the U.S. natural gas market. Its importance lies in its ability to capture local conditions and transmit them to broader markets. For companies operating in this region, understanding the dynamics of the Waha Hub is essential for planning commercial and operational strategies in an environment where infrastructure and production remain decisive factors.

Waha vs Henry Hub and Mexico exports

The Waha index cannot be analyzed in isolation. A useful reference is its comparison with Henry Hub, the main U.S. natural gas benchmark. The table below summarizes the average prices of both indices in recent years and natural gas export volumes to Mexico, providing a clear picture of Waha Hub’s regional importance.

| Year | Average Waha Price (USD/MMBtu) | Average Henry Hub Price (USD/MMBtu) | Natural Gas Exports to Mexico (BCF/day) |

|---|---|---|---|

| 2021 | 4.23 | 3.86 | 5.90 |

| 2022 | 5.18 | 6.41 | 5.69 |

| 2023 | 1.65 | 2.53 | 6.14 |

| 2024 | 0.08 | 2.18 | 6.49 |

These figures highlight how the price gap between Waha and Henry Hub reflects Texas infrastructure constraints, while exports to Mexico keep rising. For Mexican companies, understanding this relationship is essential for anticipating costs and designing effective financial hedges.